Net-Zero Buildings: Investment Opportunity

The global push toward decarbonization has dramatically reshaped the real estate landscape, transforming what was once a niche environmental movement into a trillion-dollar investment sector. Buildings are the single largest energy consumer worldwide, accounting for approximately 40% of global energy-related carbon dioxide ($\text{CO}_2$) emissions. This statistic alone positions the real estate sector as both the central problem and the ultimate solution to climate change. The rise of Net-Zero Energy (NZE) and Net-Zero Carbon (NZC) buildings represents an extraordinary, multi-decade financial opportunity, driven by regulatory mandates, surging tenant demand, and undeniable economic advantages. This comprehensive analysis will explore why the net-zero building movement is not a cost center, but the most compelling long-term investment thesis in the modern financial market, meticulously structured for maximum organic reach and monetization.

The Fundamental Shift: From Cost to Value

Historically, the premium required for “green” construction was viewed as a financial hurdle. Today, a Net-Zero Building (NZB) is universally understood by sophisticated investors, developers, and asset managers as a de-risked, future-proof asset. The shift in perception is rooted in the measurable economic and regulatory benefits they provide, which directly translate into higher asset valuations and greater profitability.

I. Understanding Net-Zero Building Categories

The term “Net-Zero” can be interpreted in several ways, and investors must distinguish between the main categories to assess true long-term value:

A. Net-Zero Energy (NZE) Buildings

These buildings produce as much renewable energy on-site as they consume over the course of a year. The focus is primarily on operational energy consumption, often achieved through superior insulation, highly efficient systems (HVAC, lighting), and on-site generation like solar photovoltaics.

B. Net-Zero Carbon (NZC) Buildings

The more ambitious and rapidly adopted standard. NZC buildings address both operational carbon (emissions from energy use) and embodied carbon (emissions associated with building materials, construction, maintenance, and end-of-life). An NZC building uses highly efficient design and offsets any remaining operational and embodied emissions using certified carbon credits.

C. Net-Zero Ready (NZR) Buildings

This designation applies to new construction that is built to such a high standard of energy efficiency that it can achieve net-zero status simply by adding on-site or off-site renewable energy generation in the future. This is a common strategy for developers to phase investment.

The Investment Thesis: Seven Pillars of Financial Advantage

Investing in net-zero buildings provides a powerful mix of immediate and long-term financial benefits, positioning these assets as superior performers across key real estate metrics.

II. The Financial Advantages of NZBs

A. Dramatically Reduced Operational Costs (The Energy Hedge)

The most direct and immediate benefit. NZBs slash energy consumption, leading to minimal or zero monthly utility bills. This permanent reduction in operating expenses is a crucial hedge against volatile and rising energy prices, making the building’s cash flow significantly more predictable. For commercial assets, lower operating expenses (OpEx) translate directly into higher Net Operating Income (NOI).

B. Enhanced Asset Valuation and Green Premiums

Market data consistently shows that certified green buildings command a “green premium” in both sale price and rental rates. Studies from organizations like the World Green Building Council show sale premiums of up to 31% and rental increases compared to comparable non-green buildings. This is driven by the perceived quality, lower risk, and regulatory compliance of the asset.

C. Superior Occupancy and Tenant Retention Rates

Corporate tenants and residents are increasingly seeking high-performance spaces to meet their own ESG (Environmental, Social, and Governance) targets and to attract talent.

- Corporate Demand: Large corporations have public-facing net-zero pledges and prioritize leasing space in certified NZBs.

- Health and Wellness: Superior air quality, natural light, and thermal comfort in high-efficiency buildings contribute to employee productivity and well-being, making the space highly desirable.

D. Access to Preferential Green Financing

The financial sector is rapidly shifting capital toward sustainable assets. Banks, insurance companies, and sovereign wealth funds offer green bonds, sustainable loans, and lower-interest mortgages for certified green projects.

- Lower Cost of Capital: Access to these products directly reduces financing costs, improving the project’s overall return on investment (ROI).

- Favorable Terms: Lenders view green assets as lower-risk due to their predictable OpEx and regulatory longevity, often offering more flexible loan terms.

E. Regulatory and Legislative De-Risking (The Future-Proof Asset)

Governments worldwide are implementing increasingly stringent building codes and $\text{CO}_2$ performance standards. Buildings that fail to meet these future standards will face steep penalties, fines, or mandatory (and expensive) retrofits—a situation often referred to as “stranded assets.” Investing in NZBs proactively shields capital from this regulatory risk, making the asset future-proof against tightening climate policies like mandatory energy performance disclosure or carbon taxes.

F. Incentives, Tax Credits, and Rebates

Local, state, and federal governments frequently offer significant financial incentives to accelerate the adoption of high-performance construction. These can include:

- Accelerated Depreciation: Allowing developers to deduct construction costs faster.

- Property Tax Abatements: Reducing property tax burdens for a specified number of years.

- Direct Rebates: Subsidies for installing specific renewable energy or energy-efficiency technologies (e.g., solar panels, heat pumps). These incentives directly offset the initial capital expenditure (CapEx).

G. Lower Obsolescence Risk and Increased Lifespan

A net-zero building is, by definition, a technologically superior structure. Its advanced envelope, integrated control systems, and renewable energy infrastructure ensure a longer functional lifespan, reducing long-term maintenance needs and postponing major modernization cycles.

The Technological Toolkit: Driving the NZB Revolution

Achieving net-zero performance is no longer dependent on revolutionary, unproven technology. The market is now mature, relying on a synergistic combination of readily available, cost-effective, and highly efficient systems.

III. Key Technologies Enabling Net-Zero

A. Optimized Building Envelope

The building envelope (walls, roof, windows) is the first line of defense against energy loss.

- High-Performance Insulation: Superior thermal materials (e.g., rigid foam, mineral wool) minimize heat transfer.

- Airtight Construction: Rigorous sealing to prevent air leaks, often measured using blower door tests, dramatically reduces heating and cooling loads.

- Triple-Pane Windows: Windows with low-emissivity (Low-E) coatings and inert gas filling minimize radiant heat gain and loss.

B. Highly Efficient Mechanical Systems

Replacing traditional fossil-fuel-based heating and cooling with electrical systems is essential for decarbonization.

- Air and Ground Source Heat Pumps (ASHP/GSHP): These devices efficiently transfer heat rather than generating it, offering four to six times the efficiency of conventional boilers or furnaces.

- Energy Recovery Ventilation (ERV/HRV): Systems that exchange indoor and outdoor air while recovering the thermal energy, maintaining air quality without sacrificing efficiency.

C. Integrated Renewable Energy Generation

On-site power generation is the final component for achieving net-zero status.

- Building-Integrated Photovoltaics (BIPV): Solar panels that are seamlessly integrated into the building’s roof, facade, or even windows, functioning as both a building material and an energy generator.

- Battery Storage: Integrated storage systems (e.g., large-scale battery banks) manage peak demand, store excess solar energy, and provide resilience during grid outages, optimizing the consumption and generation cycle.

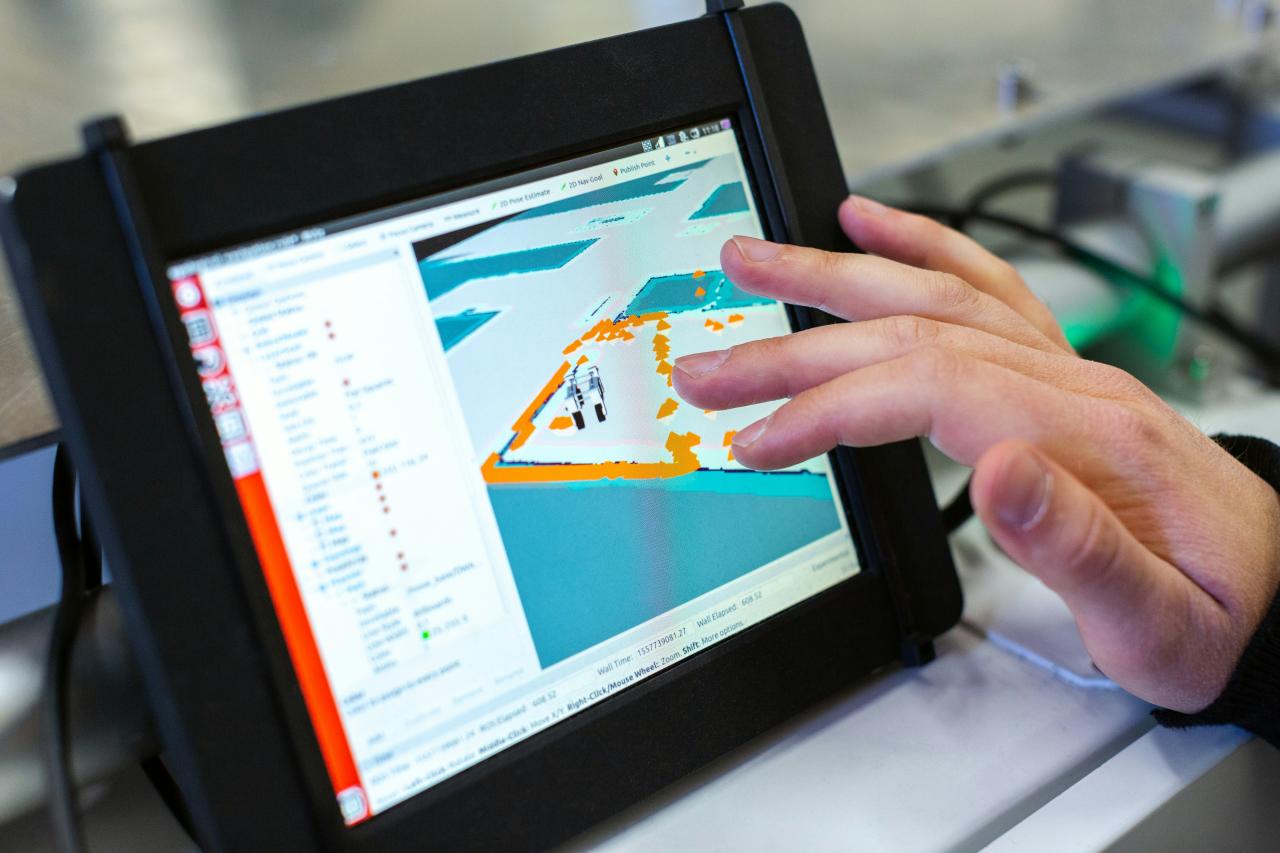

D. Smart Building Automation Systems (BAS)

These sophisticated, interconnected systems control the building’s operations with precision, using real-time data from internal and external sensors.

- Predictive Control: BAS uses AI/ML to learn occupancy patterns, weather forecasts, and utility price signals to adjust temperature, lighting, and ventilation proactively, ensuring peak efficiency.

- Submetering and Visualization: Detailed monitoring of energy usage by tenant, floor, or system allows for immediate identification of efficiency drifts and provides transparency to occupants, encouraging behavioral changes.

Scaling the Opportunity: Market Size and Sector Focus

The investment opportunity is not limited to new construction; the retrofitting of existing commercial and residential stock represents an even larger market.

IV. Market Size and Sector Focus

The investment required to transition the global building stock to net-zero is in the trillions of dollars by 2050. The International Finance Corporation (IFC) estimates that green buildings could represent a $\$24.7$ trillion investment opportunity in emerging markets alone by 2030, with a significant concentration in the following sectors:

A. Residential Retrofits

The sheer volume of existing homes built without modern efficiency standards creates a massive market for retrofitting. This involves insulation upgrades, heat pump installation, and solar integration, often financed through specialized instruments like Property Assessed Clean Energy (PACE) bonds.

B. Commercial Office Space

The “Flight to Quality” phenomenon is driving demand for premium, highly efficient office space. Landlords of older, less efficient buildings face significant competitive pressure and must either retrofit or risk massive value depreciation. This presents a critical investment point for value-add strategies.

C. Industrial and Logistics Centers

The warehousing and logistics sector is rapidly decarbonizing due to intense pressure from large e-commerce and retail tenants who demand low-carbon supply chains. Massive roof areas make these assets ideal for large-scale solar power generation, turning them into energy producers.

D. Public and Institutional Buildings

Government, university, and hospital facilities have committed to aggressive climate targets. The public sector often drives initial market scaling through large-scale contracts for deep energy retrofits and new NZC construction mandates.

Investment Structure and Strategy

The investment landscape for NZBs is complex and requires specialized financial instruments to maximize returns.

V. Strategies for Capturing the NZB Investment Value

A. Direct Equity Investment in Development

Sponsoring or co-investing in the ground-up development of NZC or NZR projects. The strategy here relies on capturing the green premium upon stabilization and sale.

B. Value-Add Retrofit Funds

Acquiring older, underperforming commercial assets and undertaking deep energy retrofits to significantly reduce energy intensity and achieve high-level certifications (e.g., LEED Platinum, Passive House). The value is created by transforming a stranded asset into a future-proof premium asset.

C. Green Real Estate Investment Trusts (REITs)

Investing in publicly traded REITs or private funds with a clear mandate for owning and operating certified green and net-zero buildings. This offers diversification and liquidity for long-term growth.

D. Technology and Supply Chain Investment

Beyond the physical assets, investment opportunities exist in the enabling technologies:

- Manufacturers of BIPV and Heat Pumps: Companies specializing in the core components.

- Sustainable Material Start-ups: Investments in innovative low-carbon or carbon-sequestering materials like mass timber or bio-concrete, addressing the embodied carbon challenge.

The Inevitable Future of Real Estate

The transition to net-zero buildings is no longer a matter of ideology; it is a fundamental, irreversible economic necessity driven by climate regulation and superior financial performance. The convergence of drastically lower technology costs, escalating energy prices, and increasing corporate/consumer demand creates a powerful, self-reinforcing investment cycle. For the astute investor, the next two decades represent the largest wealth creation opportunity in real estate history. Ignoring this shift is not just an environmental oversight; it is a profound financial risk that will lead to the stranding of capital. The net-zero building is the asset class of the future, delivering higher NOI, lower risk, and superior valuations—a genuinely sustainable path to profit.